Simple, flexible, & fast

Creating a fintech typically requires intricate processes, considerable expenses, and extensive time to launch. Our platform, user-friendly APIs, and modular SDKs enable your groundbreaking financial idea to materialize in just a few months. Additionally, collaborate closely with our seasoned finance experts to assess and customize your modern solution, ensuring compliance with regulatory norms.

03

Fast Launch

15

Services

04

Satisfied Clients

Every company is a fintech company

In the early 2010’s, it was common to hear the phrase, "Every company will be a tech company." and that prediction largely came true. However, now it seems that the new cadence is "Every tech company will be a fintech company."

Trusted By

⏱

1

Month

Launch

💳

15

Products & Services

🏛

4

Banking

Partners

💡

5

NBFC

Partners

No code, DIY platform.

Launch your app in days.

As businesses keep transforming, the notion of banking infrastructure as a service will likely grow in significance for companies across various industries. Build your fintech on your own with our Morph platform, allowing for a quicker market launch. Design, Develop, Deploy within just a few days with no-code platform.

Apply for Early Access

Products

Know Your Customer

Onboard your retail and business customers smoothly and securely with our KYC services.

Digital Banking

Build your own neo bank and offer various types of accounts with our digital banking APIs

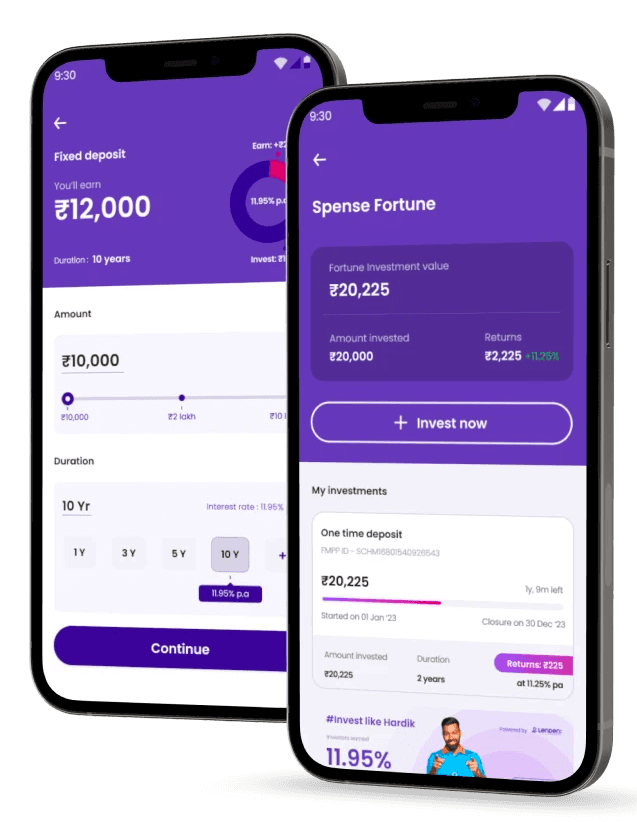

Deposits

Offer fixed deposit and flexi deposit options to your customers from 3 Banks and 4 NBFCs.

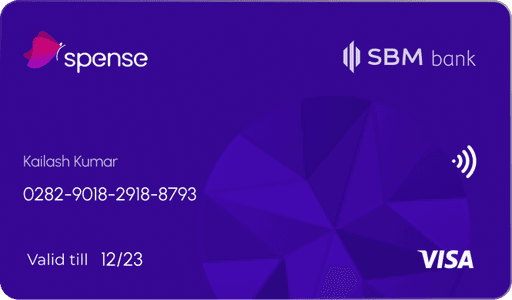

Cards & Payments

Expand your transaction possibilities using our customized Virtual Cards, Debit Cards, Credit Cards, and Secured Cards.

UPI 2.0

Elevate your fintech solution with our integrated UPI service, enabling swift and secure peer-to-peer transactions in real-time.

Escrow & Collection Services

Streamline your financial transactions with our secure Escrow and Collection services, providing a safe intermediary solution for managing funds.

Mutual Funds

Empower your platform with a comprehensive Mutual Fund stack, facilitating access to diversified investment opportunities for your users.

P2P Investments

Boost your offering with P2P Investment service, providing a dynamic platform for direct, user-to-user investment opportunities.

Digital Gold

Infuse your platform with a DigiGold Stack, opening up a digital avenue for users to buy, sell, and manage gold investments securely.

Is your cost of acquisition plaguing you?

Influencer Marketing

Reach out to our 500K social media follower community to promote your offerings. Learn more

Savings Challenge

Social savings challenge, a game changer concept and reduce the CAQ by 300%. Learn more

Talk to an expert

Got a fresh concept brewing? Finding it tough to pinpoint the perfect approach? Consult with our Industry Experts.

First 30 minutes free. Book your slot now.

Praveen Bhatt

26 years of finance experience, Ex Head of Axis Bank

With 26 years at the intersection of Digital Banking, CX, and Operations. He masterfully bridges the gap between technology innovation and crafting user-centric experiences. #DigitalBanking, #CustomerExperience, and the art of humanizing technology.

Gaurav Samdaria

Co founder, Karza

Celebrated Fortune 40 Under 40. As the co-founder of Karza Technologies and a recognized KYC expert in the BFSI sector. Delve into insights on #KYC, #BFSITrends, and the success journey of a leading tech entrepreneur.

Nicky Sehwani

Chief Business Officer, LenDenClub

A seasoned business maestro with 20+ years of leadership spanning Fortune 500 MNCs, Indian conglomerates, and cutting-edge startups. Dive deep into the realms of #fintech, #alliances, & #p2plending

Anchal Jajodia

Co founder, Cybrilla

Unlock the intricacies of Mutual Fund business and tech. From building robust stacks to seamlessly tailoring solutions. Dive deep into #PortfolioOptimization, #TechIntegration, and #SolutionCustomization

Mithun K Mahendra

SVP Axis Bank, Wholesale Banking

With 23+ years of mastering banking and finance, navigating volatility, and spearheading digital transformations, he's a beacon for #DigitalBankingEvolution and trends in #WholesaleBanking

Tejas Langalia

Chief Technology Officer, Augmont

Unearth the tech brilliance behind democratizing gold investments. Harness insights into #DigitalGoldSolutions, #TechInnovation, and the journey to making gold accessible for all.

Book your slot now

First 30 Minutes Free.

Up to ₹5,000/hour. 100% money back guarantee if the resolution provided is not satisfactory.

Regulation & Compliance Assistant

Gain insight with our AI assistance on Reserve Bank of India news, essential regulations, and adherence.

e.g. what is the latest RBI circular on card network portability?

Superior service & support

Compliance & regulation support

We comply with all applicable financial rules to ensure your fintech stays within the law.

Innovation & customization

Absolutely! Our SDKs and APIs are designed to offer maximum flexibility for seamless integration.

Go live in a month

Our no-code platform enables you to build products as a DYI solution. We handle all the intricacies bts.

Figuring things out? Talk to our experts

Got a fresh concept brewing? Finding it tough to pinpoint the perfect approach? Consult with our Industry Experts.

Superior support pre-sales and post sales

Unmatched Assistance. Top-notch Support extended not merely prior to Purchase but after-sales too.

Tech support 24x7

Distinct from the rest, receive unmatched technical aid, guidance, upkeep services, and an exceedingly stable.

Assistance in audits and reporting

Our team follows all essential financial guidelines to ensure your fintech stays in compliance.

Analytics

Gives you a better understanding of your customers´ usage, needs, and spending patterns.

We are ISO 27001 & SOC II compliant